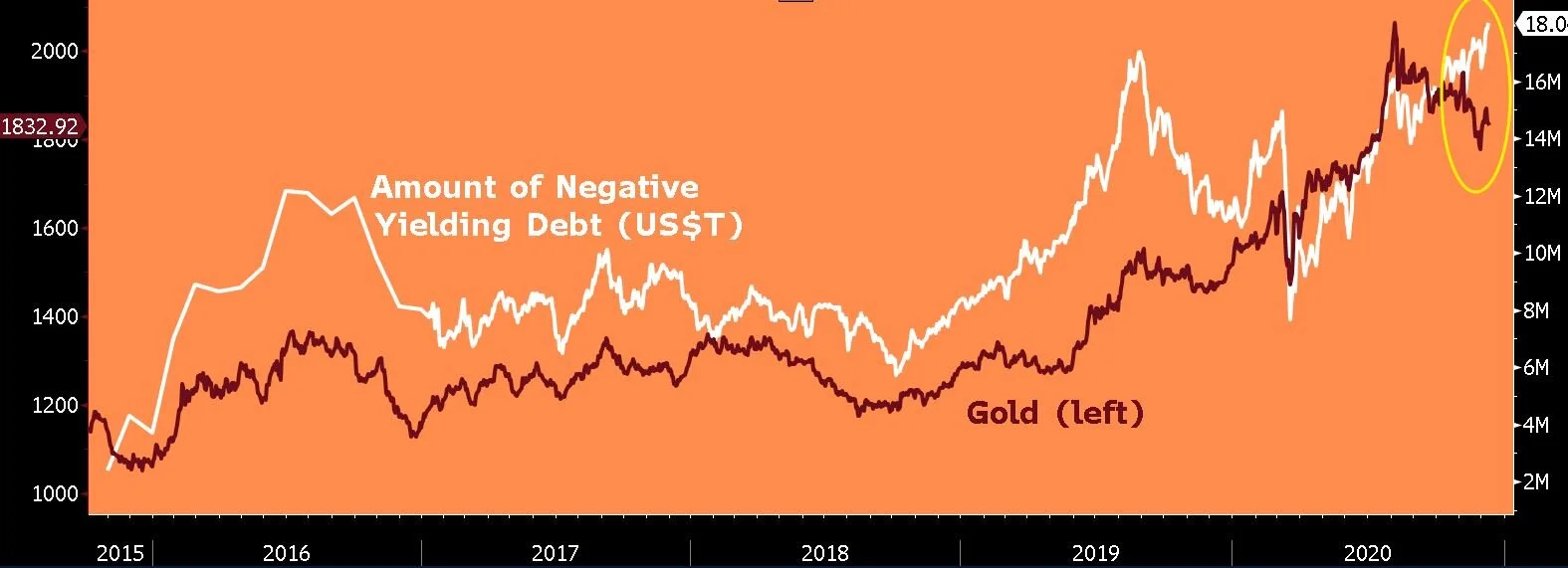

Gold should gain support from negative-yielding debt reaching a new high

If you hold physical bullion you don’t get paid a ‘carry’ yet it costs you money to buy that gold. This simple equation explains why negative rates have always been good for the price of gold, since you’re ‘getting paid to borrow’ that money. Interestingly, as you can see in this graph, recently this relationship has broken down. The white line represents the total US$ value of global debt that is trading with a negative (nominal) yield against the price of gold, in red on the left. Has bitcoin disrupted this relationship? or has the hope that vaccines will reinvigorate the global economy reduced uncertainty enough so as to overpower the historical relationship between negative rates and gold?

Disclaimer

This document has been prepared for information purposes only and is not, and under no circumstances is to be construed as, an offer to sell or a solicitation to buy any securities. The information contained herein is not intended to be, nor should it be considered as, a complete description of either the securities or the issuer of the securities described herein. All charts and illustrations in this document are for illustrative purposes only. All statements in this document are made as of the date hereof unless stated otherwise herein.

The opinions expressed in the communication are solely those of the author(s) and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

This document is not intended to provide legal, accounting, tax or investment advice. Each prospective investor should consult its own professional advisors as to legal, accounting, tax and related matters regarding the appropriateness of investing in the Funds.

Certain information contained herein is based on, or derived from, published and unpublished information provided by independent third-party sources which Forge First believes is accurate and reliable. However, Forge First cannot guarantee the accuracy of such information. The statements contained herein that are not historical facts and are forward looking statements, which are based on current expectations and estimates about particular markets. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict. Therefore, actual outcomes and returns may differ materially from what is expressed in such forward-looking statements.